Economics

Introduction

Tokenomics Goals

Tokenomics is a fundamental concept in decentralized systems that leverages economic incentives to encourage desired behaviors from participants, including nodes, users, developers, and Validators. The main goal is to create a self-sustaining and self-regulating ecosystem that maximizes benefits for all stakeholders. A well-designed tokenomics model can also disincentivize malicious behavior by imposing penalties. Additionally, tokenomics can facilitate the effective allocation and use of existing and new resources on the network, resulting in a variety of affordable services for users.

The main challenges facing decentralized systems are the need to decrease transaction costs, increase throughput, and reduce finalization time. This is particularly important for the widespread adoption of blockchain technology in real-world applications. One of the primary objectives of Waterfall tokenomics is to establish economic conditions that enable the network to expand to a size that provides an optimal data replication ratio and a maximum speed of transaction propagation. Waterfall tokenomics must encourage fast finality, which is a critical feature for supporting payment systems and decentralized applications (Dapps). It is worth noting that the Directed Acyclic Graph (DAG) structure of the network presents unique challenges and vulnerabilities that set it apart from traditional blockchain architectures. Therefore, Waterfall tokenomics must provide proper protection and security that aligns with the technical network design.

The concept of Waterfall tokenomics is a set of economic principles and mechanisms designed to support the growth and functionality of distributed networks, with a particular emphasis on DAG structures. Our task was to develop a tokenomics model that addresses these challenges, with a focus on limiting the growth of transaction fees while maintaining the economic feasibility of the Validators. To achieve this, we propose a flexible and transparent architecture that can be easily modified with a set of adjustable parameters. The set of rules and guidelines that govern the network’s economics is implemented through software that includes all essential features. These economic rules are enforced automatically and are transparent to the public. Additionally, there must be mechanisms in place that enable specific rules to adapt dynamically to changing situations.

The Waterfall model incorporates and enhances the most favorable aspects of Ethereum tokenomics. Furthermore, it presents notable benefits owing to its novel consensus protocol and horizontal scaling, with subnetworks necessitating economic incentives.

Self-sustainability. The Waterfall system is endowed with the property of self-sustainability throughout the entire life cycle. For this, a mechanism has been developed for the dynamic adaptation of system parameters to various loads, from units to millions of transactions per second. The adaptation mechanism also ensures the optimal behavior of the network for varying numbers of nodes – from dozens to hundreds of millions of nodes. This approach enables the system to achieve self-sustainability throughout its entire lifecycle.

Low transaction fees. In various scenarios, the architecture and tokenomics of the system are structured to maintain low transaction fees. The protocol scales dynamically as network load increases, which allows for the simultaneous publication of more blocks within the same slot and consequently reduced transaction fees as the system expands. Thus, transaction processing during peak times remains efficient, while the number of pending transactions in the transaction pool remains low.

Supporting high transaction throughput. The Waterfall platform achieves high transaction throughput via the use of system-scalable DAG-based block structures. As demonstrated by the TestNet, the tokenomics model effectively supports this architecture.

Coin WATER and Tokens

Tokenomics involves the use of native tokens or coins that serve as the currency of the decentralized network and facilitate transactions and interactions within the system. The Waterfall platform's native coin (WATER) serves as a primary digital asset within the network, facilitating the transfer of transactions, executing smart contracts, and providing for the creation of auxiliary tokens, thereby creating an ecosystem with the potential for mutually beneficial interactions among all its components. The initial supply of coins is 25 billion, which are put into circulation in such a way as to provide the best conditions for the development of the system.

Additionally, one can create embedded tokens on the platform. Therefore, the release and maintenance of tokens (including NFTs) do not demand special smart contracts but are carried out with ordinary transactions. Such an approach significantly reduces overhead charges. In addition, this makes the usage of tokens more accessible to a wide range of users.

Macroeconomic Design

Coin Flows

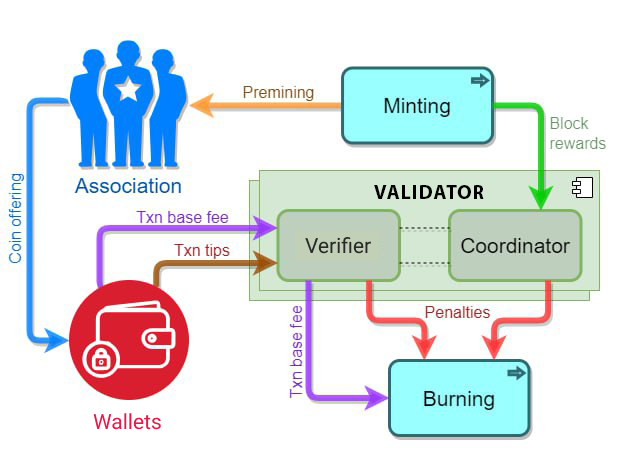

This chapter covers the platform's governance framework, which includes core principles of network economic policy that shape the interactions of community groups and affect various economic indicators such as cryptocurrency rates, inflation, and deflation. The system's design and coin flows are visually represented in Figure 1 and are discussed in depth further. More detailed information on Waterfall’s tokenomics design can be found in [1] and [2].

Validator’s Stake

Every network account can stake a fixed number of coins (e.g., WATER) to become a Validator for platform operation. Additionally, an appropriate number of Validators will be created to provide an effective and secure network at the first stage. To make this happen, the necessary number of coins is allocated from the Association.

It is also possible to create light-Validators having fixed stakes. Their usage significantly expands the set of devices on which the Validator software can be installed, facilitating overall network decentralization.

Coin Mining

Block production is incentivized with minted rewards for each finalized block of the Coordinating network. In other words, new coins will be issued to cover the cost of rewarding Coordinators for achieving necessary security guarantees, so-called Minimum Necessary Issuance. Earned coins are accrued to Coordinators every epoch. The annualized minted amount () depends on the total amount of staked coins ():

where e.g. (20%) is the maximum annualized reward rate at the total stake billion.

Hence, the maximum annualized reward rate () equals:

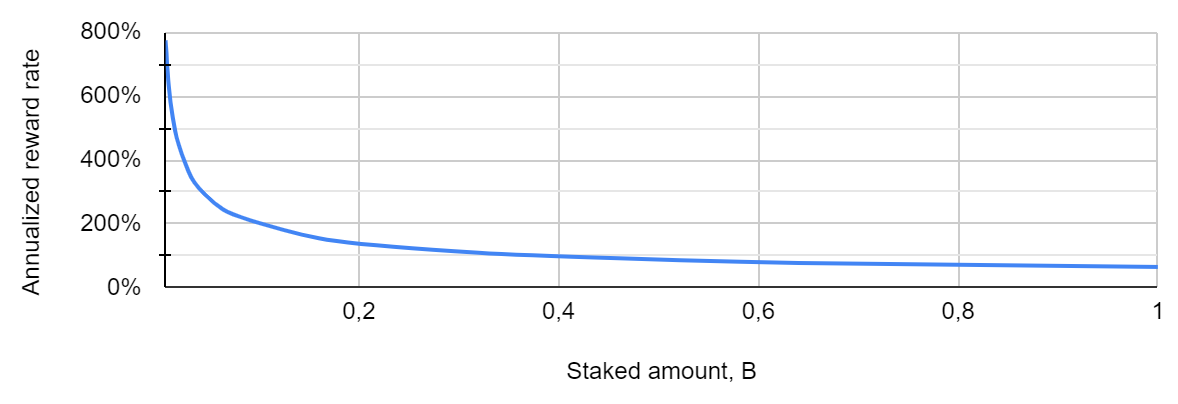

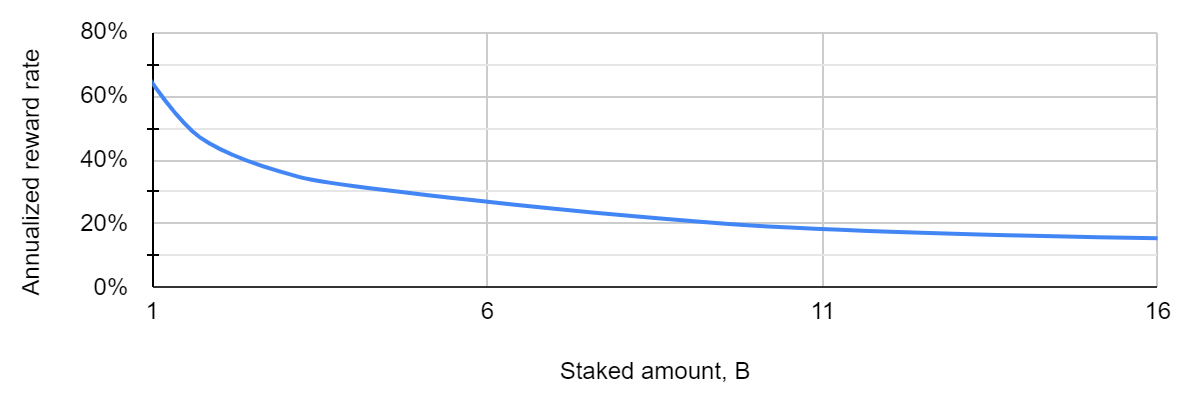

This proposed non-linear relationship means that as the number of staked coins decreases, incentivization increases, and vice versa. Therefore, a balance between the volume of minted coins and network security is ensured. Figure 2 depicts the maximum annualized reward rate that could be generated by stakeholders as block rewards, at various total staked amounts.

At the initial stage, when there is a small number of Coordinators, a significant annualized reward rate can be assumed. With 65.6 million staked coins, the reward rate is expected to be 242%, which should contribute to the expansion of the network. However, as the number of Coordinators increases, the reward rate decreases sharply. For instance, with the stake of 1.5 billion WATER, the expected reward rate drops to 50%. Further, with 3.2 billion WATER, the expected reward is around 35%, and it reaches an optimal value of 20% with 9.6 billion WATER staked. We should note that these rates are for preliminary lab tests and differ in the Mainnet.

A minted reward for a produced block can be obtained by considering the values of the annualized minted amount and slot times. Let be the slot number of the Coordinating network.

Then:

where is its time in seconds and is the number of seconds per year. Therefore, the minted reward per block is:

It is important to note that the total sum over all slots of the Coordinating network per year is equal to . Further, the amount will be split among the committee leader and members that produced -th block in the Coordinating network.

Base Transaction Fee

A base transaction fee must be paid for any transaction included in a block. Its value is influenced by the total number of Verifiers in the system. The mechanism of its formation is similar to the way a minted reward is obtained and depends on the annualized minted amount. Let -th be the slot:

where the number of blocks per slot in the Shard network and is its time in seconds.

Finally, a base transaction fee in -th slot is defined as:

where is the needed gas amount to process that transaction, million is the total allowable gas amount per block, and is a price multiplier. For an ordinary transaction the ratio:

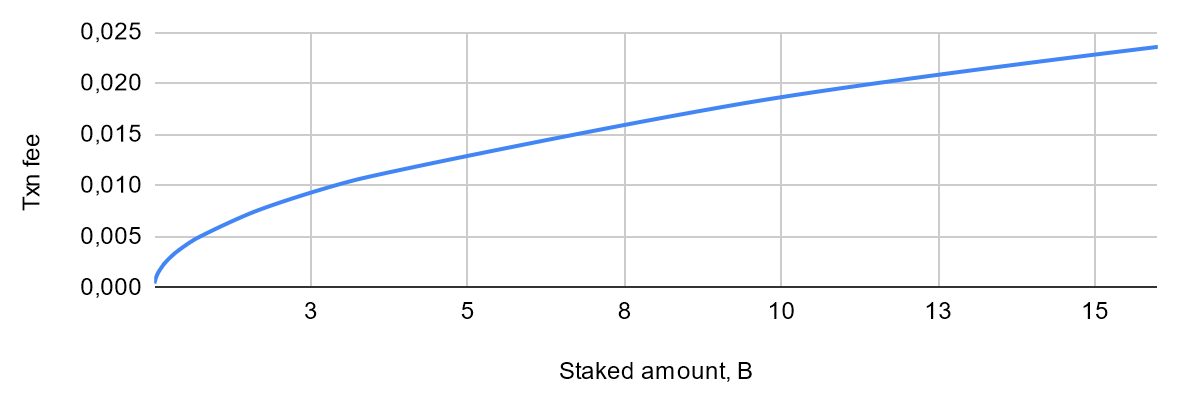

ensures quite low base fees. Clearly, the value of depends on the number of blocks per slot and the slot time in the Shard network, as well as the total staked amount (Figure 3). For instance, when only 6.6 million coins are staked in the system, the base transaction fee is just 0.0005 WATER, but with a total stake of 9.6 billion coins, the fee increases almost fortyfold. However, a significant larger number of Verifier results in greater network reliability and security of the platform.

On/Off Boarding Fees

When onboarding and off-boarding transactions are included in the -th block, the block-producer mints himself an amount equal to . Moreover, when adding an off-boarding transaction, an amount equal to is burned from the Validator leaving the account. Thus, due to the high reward compared to the usual transaction fees, the on- and off-boarding transactions are prioritized. At the same time, malicious members will be prevented from benefiting from the repeated creation and liquidation of Validators.

Coin Burning

The act of permanently removing a certain number of coins from circulation to reduce the current supply is commonly referred to as "coin burning." This process is often carried out by sending tokens to an account that can receive them but cannot withdraw them, rendering the coins useless and irretrievable. In the Waterfall model, a part of base transaction fees are burned to improve the system economics, but Verifier are allowed to keep the rest and tips from transactions. The tip amount is at the discretion of the sender; however, a default value could be recommended by the wallet. Further, the base transaction fee can be split into two portions with a burning multiplier :

The first component is burned but the second one is left for a Verifier. A lower value of increases the total Verifier`s rewards and reduces the burned coin amount. This value can be the same for all blocks and changed only by the network voting, or it can depend on a particular block or the reputation of a block-producer to incentivize it.

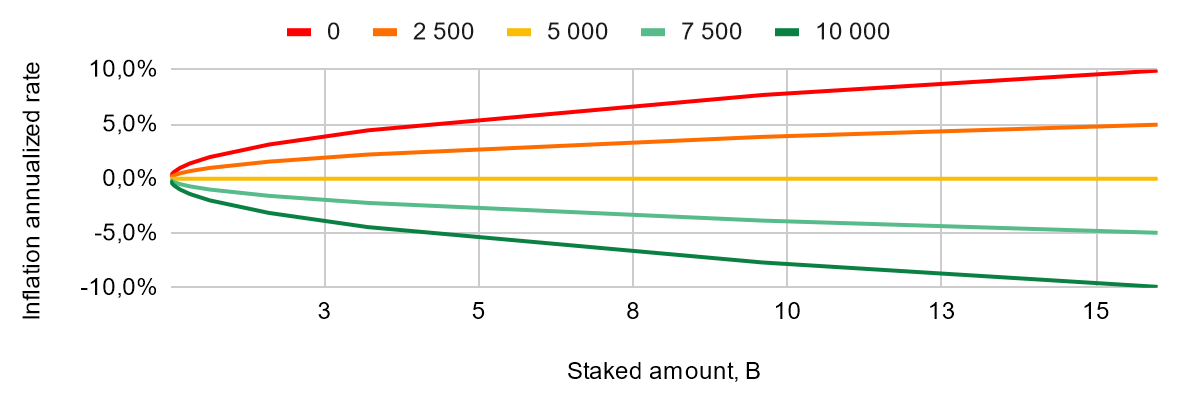

Inflation and Deflation

In tokenomics, increases and decreases in the circulating coin supply are called inflation and deflation, respectively. Hence, the interplay between the volume of minted coins (as Coordinators’ rewards) and burned coins (as base transaction fees) determines whether the system experiences inflation or deflation. Despite the high annualized reward rate at the outset of the system with a total stake of 6.6 million coins, the percentage of the minted amount of the total supply is insignificant – 0.2%. However, as the number of Validators grows, this percentage gradually increases, leading to an annual inflation rate of 7.7% when 9.6 billion WATER are staked.

In addition, the number of transactions per second has a significant impact on the inflation/deflation process. With a higher block occupancy, a deflationary trend can occur, since as more transactions take place, more coins are burned as transaction fees, which can help offset the inflationary effects resulting from the creation of new coins.

Let's consider such an example (Figure 4). At 5,000 ordinary transactions per second with 4 blocks and 4 seconds per slot in the Shard network, the inflation rate equals zero. With more transactions per second, a deflationary process begins. For instance, at 7,500 transactions per second and a total stake of 9.6 billion WATER, deflation reaches almost 4%.

Incentive System

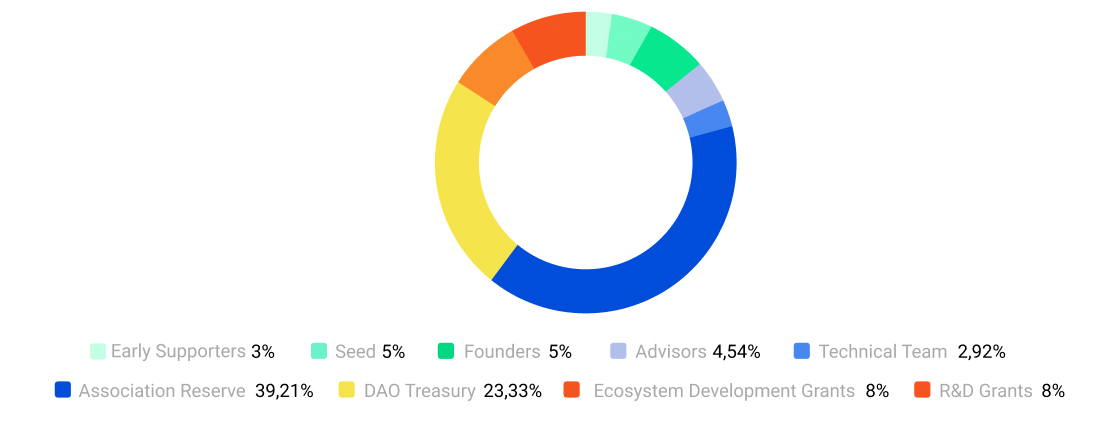

Token Allocation

-

Early Supporters: 3%

TGE 5%, 6 Month cliff, linear vesting over 24 Months -

Seed: 5%

TGE 5%, 6 Month cliff, linear vesting over 18 Months -

Founders: 6%

TGE 5%, 6 Month cliff, linear vesting over 24 Months -

Advisors: 4,54%

TGE 5%, 6 Month cliff, linear vesting over 24 Months -

Technical Team: 2,92%

TGE 5%, 6 Month cliff, linear vesting over 54 Months -

Association Reserve: 39,21%

Planned for further development and advancement of the technology and the ecosystem -

DAO Treasury: 23,33%

Planned for Association daily operation -

Ecosystem Development Grants: 8%

Subject to vesting, with terms determined on a case-by-case basis -

R&D Grants: 8%

Subject to vesting, with terms determined on a case-by-case basis

Rewards

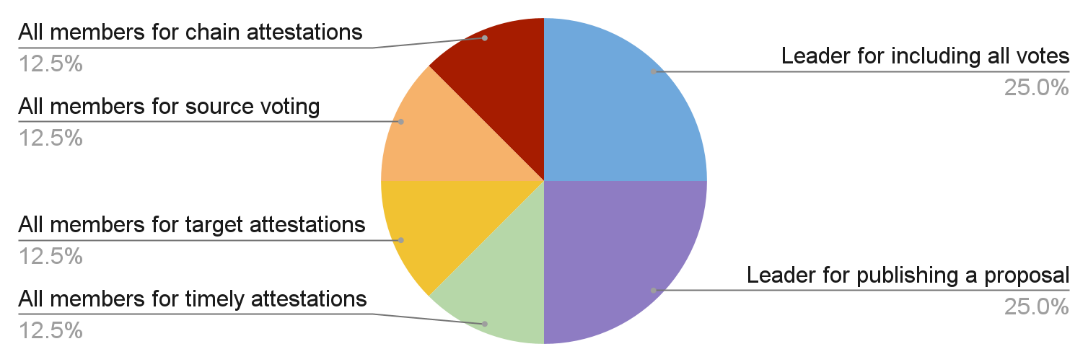

In the Waterfall network, each Verifier is entitled to create blocks in certain slots of the Shard network. As was previously mentioned, block producers in the Shard network are now able to receive tips, and they will be further rewarded with a portion of the transactions fee. In the Coordinating network, block creation is incentivized with minted rewards (). According to the rules of the consensus protocol, a few committees participate in every block voting, and each of them has members chosen from among Coordinators.

We consider that voting itself and the inclusion of a proposal and votes within a block are equally important to successfully achieve consensus. The key principles underlying the proposed scheme are that Coordinators should be rewarded in proportion to the significance of their contributions. Therefore, rewards are paid to:

- each committee member who casts a valid vote;

- the slot leader for a proposal that was supported by a committee member;

- the slot leader for including this vote in its block.

In its turn, the committee member's reward consists of 4 equal parts for voting on:

- the latest up-to-date chain of spine blocks in the DAG;

- the source block in the Coordinating network;

- the target block in the Coordinating network;

- and the last quarter – for voting on time. The longer voting is delayed for each block, the lower its reward.

Figure 5 depicts the distribution of a block reward between the slot leader who published the chain of spine blocks from the Shard network, the slot leader who included the votes in the block, and all committee members, subject to correct voting and timely inclusion of all attestations.

The timeliness reward decreases as delayed slots increase. For example, if a committee member votes one slot later, then the corresponding reward is halved, and if the attestation occurs two slots later, then this reward is reduced three-fold, etc.

Penalties

Waterfall is a public decentralized and open-source peer-to-peer platform, which means that any individual or group can participate in the network. To ensure high security and continuous operation of the network, a system of penalties for malicious nodes is introduced.

The key principle governing the calculation of penalties is that they should be significantly higher than any potential gains that could be realized through an attack on the system. To achieve this, a multiplier of is used to amplify the scale of the penalties. All types of penalties are charged automatically in the case of a Validator’s faulty behavior:

- a Coordinator as a committee member makes a series of vote omissions;

- a Coordinator as a committee member signs and sends conflicting messages (e.g., double voting);

- a Coordinator as a block-producer does not create a valid block in the Coordinating network;

- a Coordinator as a block-producer creates more than one block in the same slot of the Coordinating network;

- a Verifier creates more than one block in the same slot of the Shard network, and those blocks are finalized in the Coordinating network;

- a Coordinator provides invalid proof of the above-mentioned offenses.

These decisions are made by all Coordinators, based solely on information from the coordinating ledger. A whistleblower who finds an offense records a corresponding proof in a block when it is its turn to produce a block. Hence, there is no need for an additional network consensus. Penalties are cumulative, e.g., if three blocks are created instead of one, then the penalty is doubled.

A Validator loses the right to verify and produce blocks in the future if the coin amount on a Validator’s account becomes less than 50% of the initial stake. In such a case, the rewards received are not taken into account. The overarching goal of this process is to ensure that faulty or idle Validators are eventually excluded from the consensus, thus preventing the accumulation of a critical mass of defective nodes that could hinder consensus. At the same time, temporary equipment failures or inadvertent shutdowns of Validators should not result in a permanent ban from the system.

In addition to the penalty, the Validator's participation in the network is temporarily suspended for the current and next eras, so that the necessary equipment settings can be made. This helps to preserve the value of the Validator's stake, as subsequent failures would cause the stake to fall below the 50% threshold, leading to permanent exclusion from the network. While Validators are suspended, they do not take part in committee work or block production, which in turn reduces the percentage of faulty nodes in the network.

In summary, the tokenomics models for incentivizing Validators’ behavior is tightly integrated into the system architecture and the corresponding consensus protocol, taking into account all of their features, and facilitating a favorable and supportive environment with equal rights for all participants. More detailed information on rewards and penalties is presented in [3] and [4].

Simulating

The presented tokenomics model was tested with 8.2 million staked coins. The results obtained using a simulation in the Waterfall testnet were fully in line with theoretical calculations made by the formulas.

Allocations and mechanics described on this page are subject to change at the Association’s discretion.

References

-

Grybniak, S., Leonchyk, Y., Masalskyi, R., Mazurok, I., & Nashyvan, O. (2022). Waterfall: Salto Collazo. Tokenomics. IEEE International Conference on Blockchain, Smart Healthcare and Emerging Technologies (SmartBlock4Health), 1-6. DOI: https://doi.org/10.1109/SmartBlock4Health56071.2022.10034521.

-

Grybniak, S., Leonchyk, Y., Mazurok, I., Nashyvan, O., & Vorokhta, A. Waterfall: Salto Collazo. High-Level Design of Tokenomics. Advances in Science, Technology and Engineering Systems Journal, 8(3), 231-243. DOI: https://doi.org/10.25046/aj080326.

-

S. Grybniak, Y. Leonchyk, R. Masalskyi, I. Mazurok, and O. Nashyvan, (2022). An Incentive System for Decentralized DAG-based Platforms. IEEE Blockchain, TechBreif, Q4. [On-line]. Available at: https://blockchain.ieee.org/images/files/pdf/techbriefs-2022-q4/an-incentive-system-for-decentralized-dag-based-platforms.pdf.

-

Mazurok, I., Leonchyk, Y., Grybniak, S., Nashyvan, O., & Masalskyi, R. (2022). An incentive system for decentralized DAG-based platforms. Applied Aspects of Information Technology, 3(5), 196-207. DOI: https://doi.org/10.15276/aait.05.2022.13.