Aave Demo

Disclaimer

No partnership has been formed, nor endorsement received, from Aave. We are simply migrating the open source code to our protocol.

access

Login: demo

Password: demo

The following financial instruments are implemented on the exchange: - deposit and loan market; - Aave Swap exchanger;

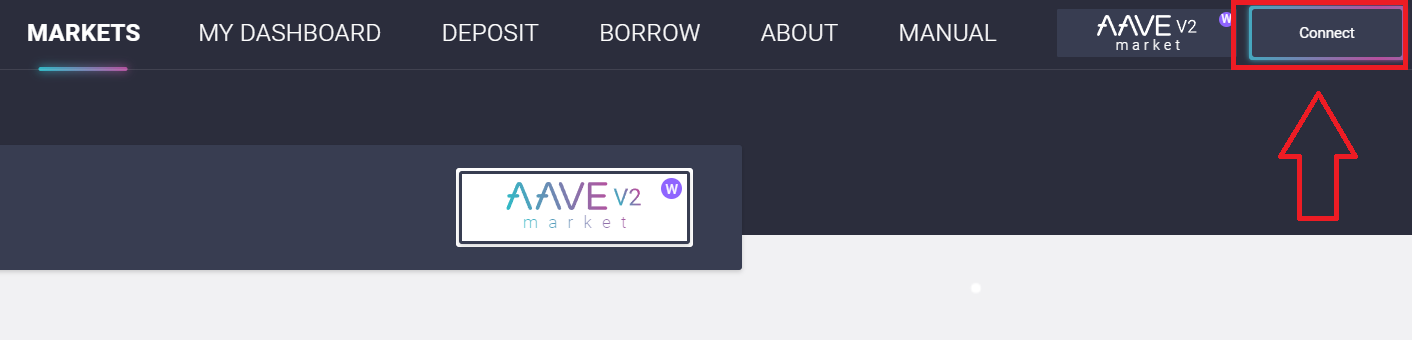

To use all functions of the exchange, you need to connect a Metamask wallet. To get started, open the Aave dApp and click on "Connect" in the upper right corner.

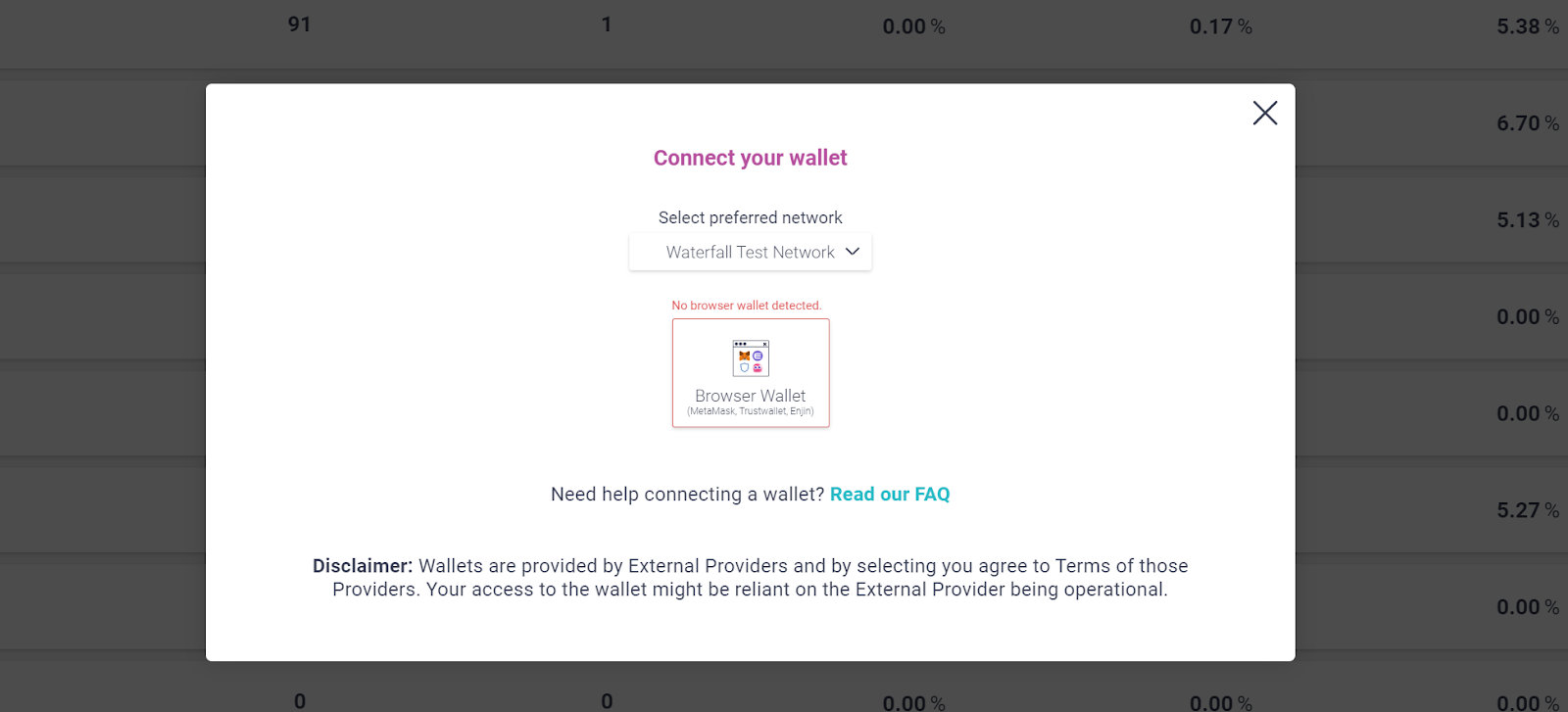

In the window that appears, select the Waterfall network and connect your wallet. Your account will be created automatically after connection.

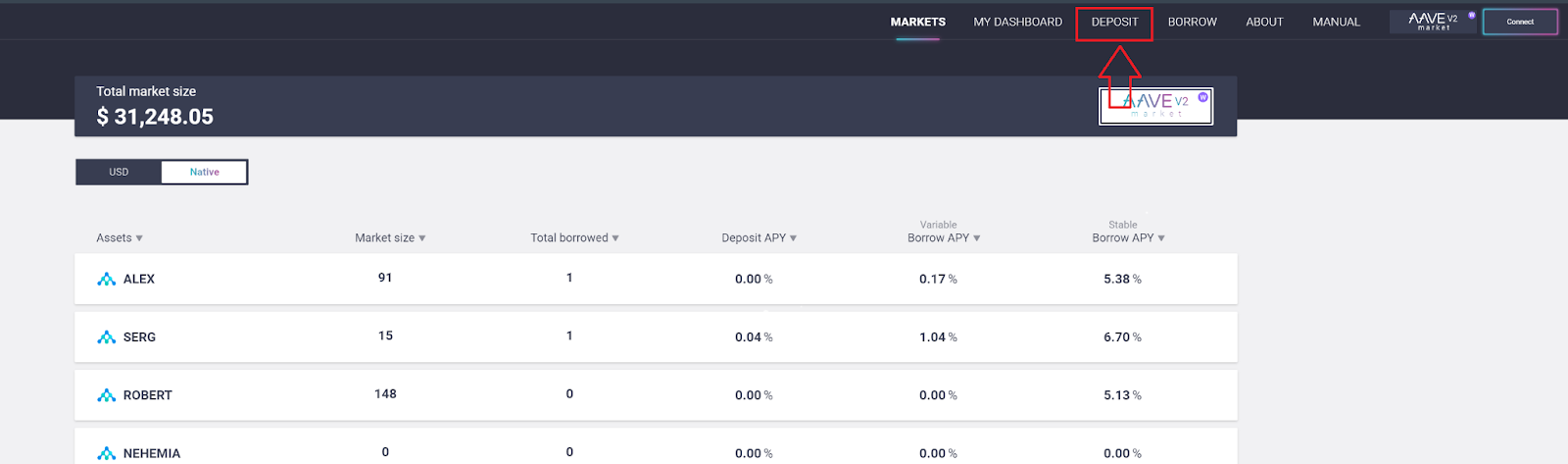

To use the exchanger, get credit or start stacking AAVE, you need to make your first deposit. To do so, go to the appropriate section.

Choose one of the pools. For convenience, you can filter the list by annual percentage rate (APY). Below is the effective annual percentage rate (APR) calculated for the last 30 days. Simply transfer funds from your wallet to the pool and wait for confirmation of the transaction. Your deposit will be displayed in the "Your wallet balance"

Once you’ve made your deposit, you will have access to all Aave financial instruments.

Deposit and Credit Market

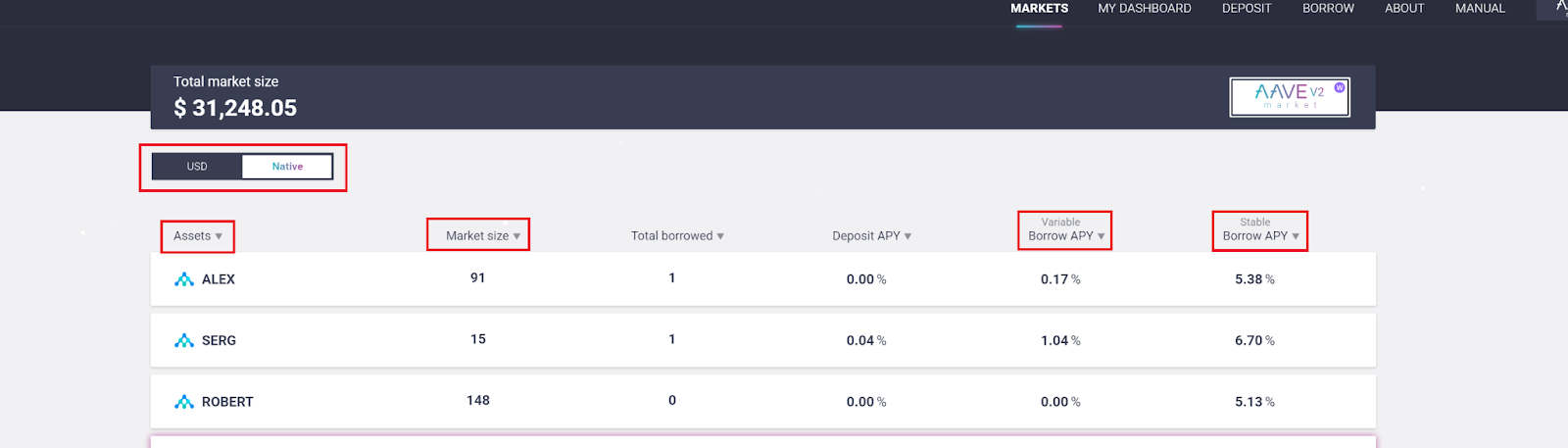

Open the "Markets" section. Here you can see all the available deposit and credit pools. On the left you can select the currency you want the pool volume to reflect (AAVE token or USD). On the right is the interface to switch networks to AAVE v2.

In the AAVE v2 network, you can trade pledged assets as well as refinance current loans.

The list provides basic information about the pool:the number of frozen funds, annual rate of deposits (Deposit) and loans (Borrow). Depositor remuneration consists of two parts: a share of interest payments, and a commission of 0.09% for the use of term loans.

Note: The loan amount cannot exceed the current pledge (deposit). The ratio of collateral to loan changes the "health coefficient" – the level of solvency of the client. If the health coefficient falls below 1.0, liquidation will occur – writing off 50% of the collateral against the loan (the amount owed will also decrease by 50%).