Curve Demo

Disclaimer

No partnership has been formed, nor endorsement received, from Curve. We are simply migrating the open source code to our protocol.

access

Login: demo

Password: demo

Curve’s Smart Contract encourages users to maintain a balance of liquidity pools. Protocols automatically increase the pool’s annual percentage rate (APY) when limits are overspent, to maintain a stable price for tokens. Compound and yearn.finance lending services are integrated into the Curve protocol, so pool assets are always secure.

The exchange ecosystem also involves 3CRV tokens as liquidity provider tokens.

By blocking CRVs in Curve protocols, the user can increase revenue by 2.5 times to provide liquidity. Long-term blocking converts CRVs into veCRV tokens. To start the increased interest program, you need to re-lock the veCRV tokens.

To take advantage of Curve, connect a cryptocurrency wallet to the exchange. To do so, go to the application and click "Connect wallet."

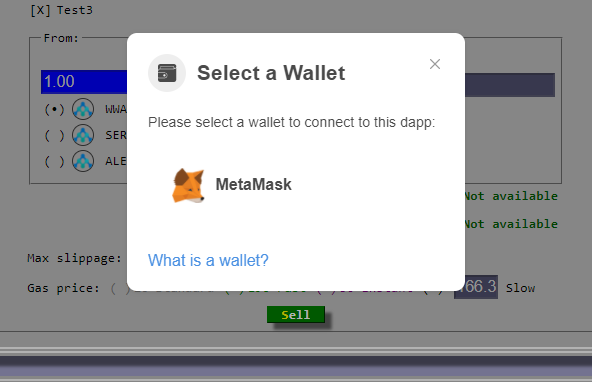

MetaMask is an online digital wallet created for the storage of Ethereum-based (ERC-20) cryptocurrencies. The MetaMask digital wallet is often required in order to transfer cryptocurrencies to a DEX such as Curve Finance.

You must have cryptocurrency funds in your MetaMask digital wallet to connect your wallet to Curve Finance.

Exchange

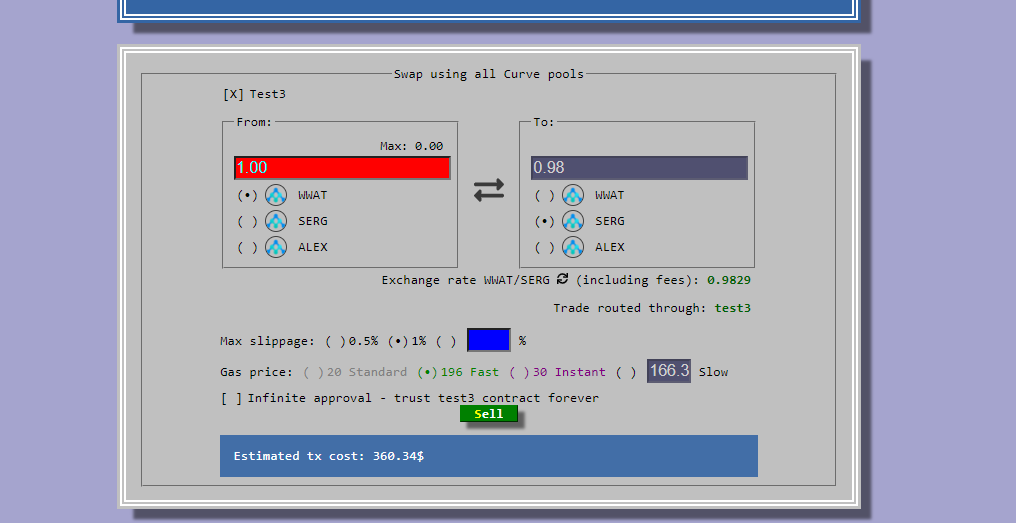

Choose the tokens you want to exchange. Below you can see the current exchange rate and the exchange fee.

Click "Sell" to start the transaction. For your first transaction on the exchange, you will need to send a confirmation.

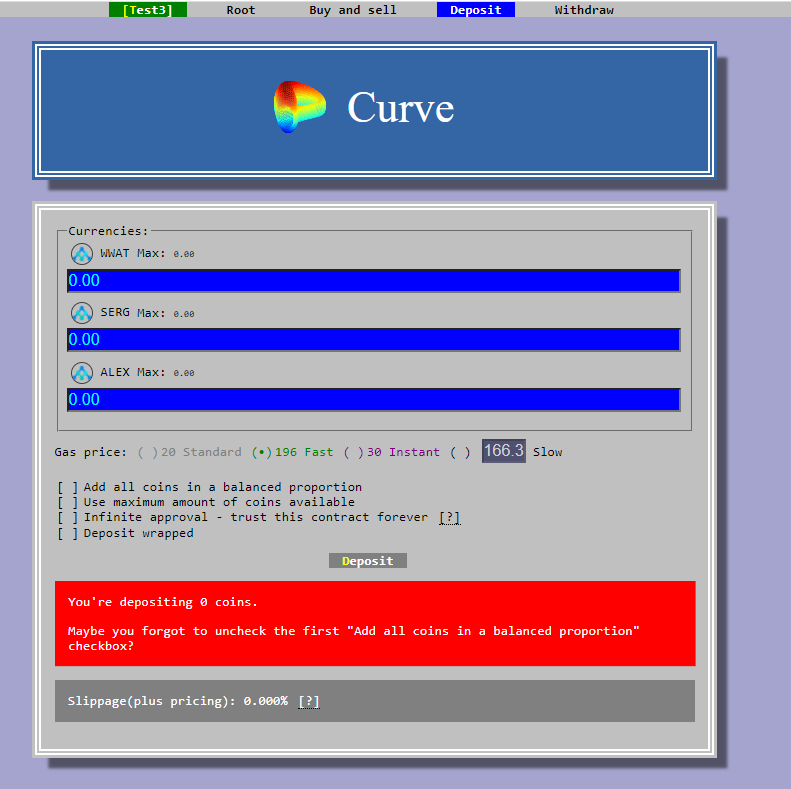

Deposit

To deposit liquidity into a pool, you will gain exposure to every cryptocurrency in that pool. If a pool contains five cryptocurrencies, your stake will be distributed across all five cryptocurrencies in that pool. The ratio between tokens constantly varies.

To add liquidity to Curve: 1. Open the Curve dApp, where you will be prompted to connect a web 3.0 wallet. Connect your MetaMask wallet. 2. To select a pool, click on the menu icon at the top left of the page and select the pool to which you would like to provide liquidity. 3. Enter the amount of each cryptocurrency you wish to deposit in the boxes provided. Below the list of cryptocurrencies, tick your preferred option. 4. Click "Deposit" when ready. You will then be prompted by your connected web 3.0 wallet to allow the transaction. Make sure you are comfortable with the associated gas (transaction) fee. 5. Once ready, click "Confirm" in your web 3.0 wallet to initiate the transaction. 6. You will then receive the associated liquidity provider (LP) tokens, which are basically an "IOU" for the staked tokens in Curve. 7. Head to Curve to check the amount you have staked in Curve Finance.

Curve liquidity pools

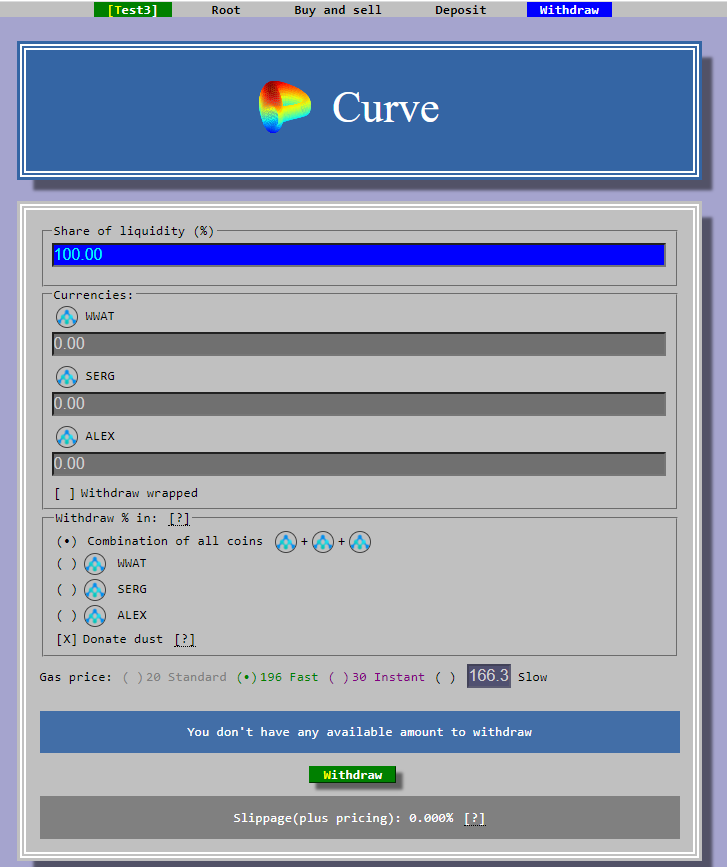

Go to the "Withdraw" section.

Choose a suitable pool and freeze your assets. Remuneration will be accrued daily. To withdraw funds, select the interface of the appropriate pool and click "Withdraw". To earn extra income for your liquidity supply, use CRV Stacking.

Note: to access the pool, you must have adequate tokens in your account.

Conclusion

Curve ranks second among DEX exchanges by the number of frozen assets. Users are attracted by the high interest rates of the pools with stabelcoins, as well as low fees of the exchanger. Of the disadvantages – uncomfortable interface of the site.